Liability & Property Insurance for CCSAA Affiliated Nordic Centers & Cross Country Ski Operators

Please feel free to call us toll free at 1-844-840-1400 with any questions.

PART I: GENERAL LIABILITY COVERAGE

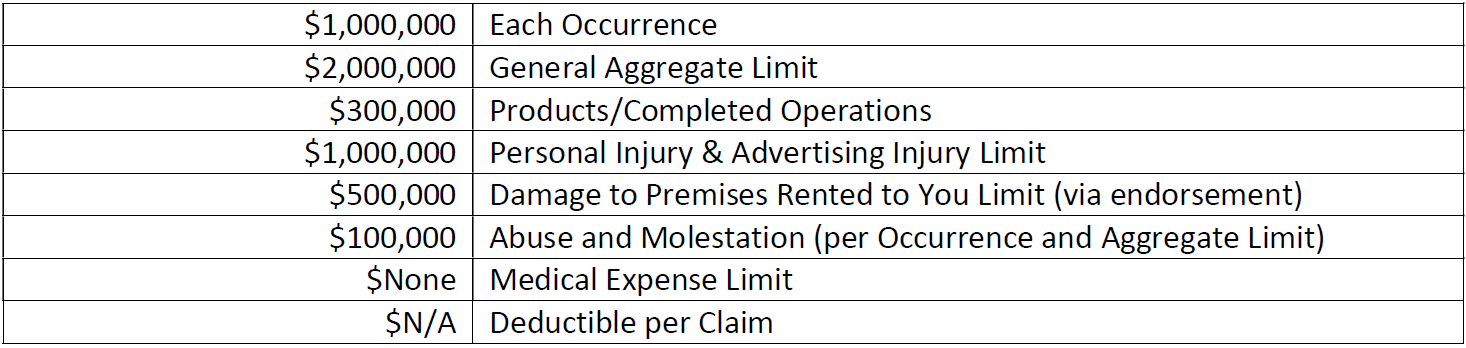

Standard program limits (GL)

Carrier: Everest National Insurance Company (Admitted)(A+ Excellent XV AM Best)

(Protects you in the event of a lawsuit or property damage)

WHO IS COVERED

This $1,000,000 occurrence form general liability program provides protection for your organization’s owners, directors, instructors, volunteers and employees against claims of bodily injury liability, property damage liability, personal and advertising injury liability, and the litigation costs to defend against such claims. There is no deductible amount for this coverage. Coverage is offered through the Specialty Insurance Purchasing Group, pursuant to the Federal Risk Retention Act of 1986.

General Liability insurance - typical covered activities and coverage notes:

General Organization Operations

Trail Grooming

Members-Only events and meetings

Trail Building and Maintenance activities

Activities as indicated in the Application

All operations are potentially subject to underwriter review and approval. Any operations relating to Lodging, Back-Country Skiing, Snow Tubing or Tobogganing will automatically trigger underwriter review.

Members-Only events and meetings

General Liability insurance - coverage notes:

Host liquor liability included

General negligence claims

All activities necessary or incidental to conduct of activities

Cost of investigation and defense of claims, even if groundless

TRIA is included and cannot be rejected

Primary and Non-Contributory wording endorsement included

Waiver of Subrogation endorsement included

Additional Insured endorsement included (Additional Insureds must be included in application and include the entity name and full mailing address)

Increased Limits (Each Occurrence or Aggregate Limit) not currently available

CCSAA will automatically be included as an Additional Insured for CCSAA Members.

General Liability insurance - exclusions:

Use of heavy machinery (defined in policy as “mobile equipment”) is not covered under standard general liability premium rating (i.e. Sitting or Standing operated Bobcats, Backhoes, Bulldozers, Tractors, Power Wheel Barrows and Augers or similar machinery). Can be added for additional premium

Inflatable Amusement Devices, Carnival Rides, Knockerball/Bubble Soccer, Bungee Devices, Fireworks, Mechanical Bucking Devices: including Multi Ride Attachments, Permanent & Mobile Rock Wall Structures, Security Forces, Trampolines, and Zip Lines.

Coverage is available separately for any race, timed-event or other event organized and/or sponsored by your Club and referenced under “Event Coverage” below. Such Event Coverage would cover any Member, non-Member or General Public participants registered for the event.

War, Terrorism, Expected or Intended Injury, Asbestos, Nuclear Energy, Total Pollution, Fungi or Bacteria, Aircraft or Watercraft, Pyrotechnics, Employment Related Practices, Communicable Disease (Hepatitis, TSE, HIV, HTLV, or AIDS) and Lead Liability.

Sexual Abuse and Molestation

Liquor Liability not available in AK, AL, VT and DC

State of NY, PA, WA, VT and OK: Coverage is available, however, minimum premiums of $2000 will apply (includes Blanket Additional Insured status and no RPG fee will apply).

States of OK, NH and VT: Coverage is available, but includes state specific RPG declarations page.

NOTE: 25% of total premium is Fully Earned at Inception. RPG Fee is non-refundable.

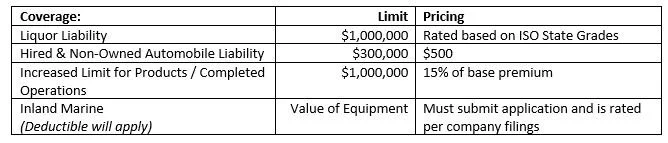

The Optional Coverage(s) (for Additional Premium - see below):

Optional coverage notes:

12 and 15 passenger vans require approval for Hired and Non-Owned Auto Coverage

Liquor Liability - Minimum Premium can apply and varies by state

Note: 100% of total premium is Fully Earned at Inception. RPG Fee is non-refundable.

HIRED AND NON-OWNED AUTOMOBILE LIABILITY COVERAGE

This liability coverage provides protection for rented, borrowed and other non-owned vehicles driven on race event business. Note: 12+ passenger vans require approval for Hired and Non-Owned Auto Coverage.

Inland marine (equipment) coverage

Provides property coverage for owned or rented equipment. Deductible will apply.

Liquor liability coverage

Minimum Premiums can apply and vary by state. Note: host liquor liability is automatically included in the standard General Liability coverage above.

PART II: SPECIAL EVENT LIABILITY COVERAGE

Coverage for Special Events organized and/or sponsored by your Organization and open to the General Public.

Separate Subscribing Member Certificate issued with separate set of Limits applying to each Certificate.

Coverage Limits, terms and conditions same as above unless otherwise noted.

NOTE: 25% of total premium is Fully Earned at Inception. RPG Fee is non-refundable.

Insurer

The General Liability coverage provided by Everest Insurance "A+ XV" (Excellent) rated by A.M. Best Company.