Liability Insurance for IMBA Affiliated Mountain Bike Clubs & Chapters and others

Please feel free to call us toll free at 1-844-840-1400 with any questions.

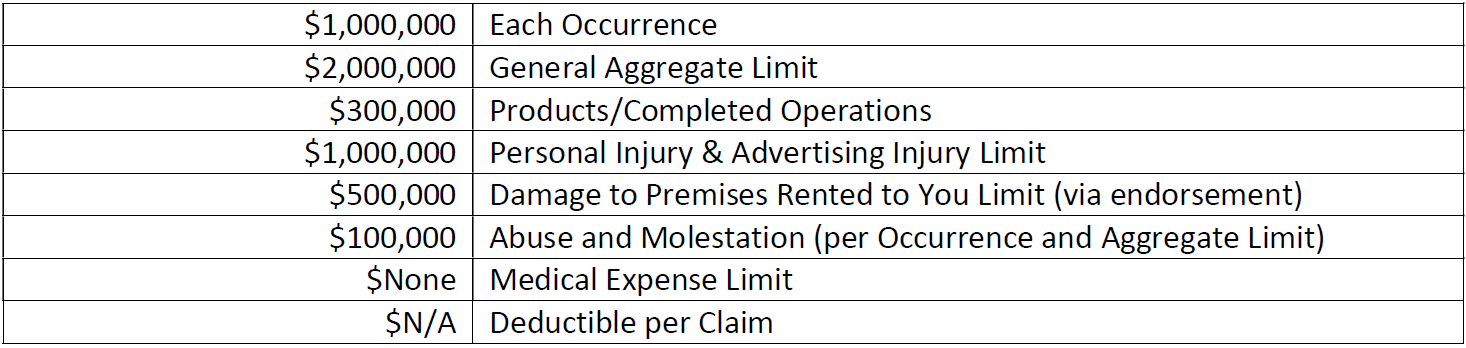

PART I: GENERAL LIABILITY COVERAGE

Standard program limits (GL)

Carrier: Everest National Insurance Company (Admitted)(A+ Excellent XV AM Best)

(Protects you in the event of a lawsuit or property damage)

WHO IS COVERED

This $1,000,000 occurrence form general liability program provides protection for your Club’s owners, directors, instructors, volunteers and employees against claims of bodily injury liability, property damage liability, personal and advertising injury liability, and the litigation costs to defend against such claims. There is no deductible amount for this coverage. Coverage is offered through the Specialty Insurance Purchasing Group, pursuant to the Federal Risk Retention Act of 1986.

General Liability insurance - typical covered activities and coverage notes:

General Chapter/Club Operations

Ongoing Rides & Activities involving Members and Non-Members (e.g. prospective members)

Members-Only events and meetings

Trail Building and Maintenance activities:

Trail building and maintenance activities include use of small hand-held power tools: i.e. line trimmers, leaf blowers, lawn mowers, brush cutters and chainsaws.

With respect to claims from the general public (e.g. “just riding along” claims), the policy ONLY will pay claims where there is clear liability on behalf of the trail building organization, and there is a smaller sub-limit ($300,000 Products / Completed Operations Aggregate Limit)

General Liability insurance - coverage notes:

Host liquor liability included

General negligence claims

All activities necessary or incidental to conduct of activities

Cost of investigation and defense of claims, even if groundless

Ownership, use, or maintenance of gyms, fields, or practice areas

TRIA is included and cannot be rejected

Primary and Non-Contributory wording endorsement included

Waiver of Subrogation endorsement included

Additional Insured endorsement included (Additional Insureds must be included in application and include the entity name and full mailing address)

General Liability insurance - exclusions:

Use of heavy machinery (defined in policy as “mobile equipment”) is not covered under standard general liability premium rating (i.e. Sitting or Standing operated Bobcats, Backhoes, Bulldozers, Tractors, Power Wheel Barrows and Augers or similar machinery). Can be added for additional premium

Inflatable Amusement Devices, Carnival Rides, Knockerball/Bubble Soccer, Bungee Devices, Fireworks, Mechanical Bucking Devices: including Multi Ride Attachments, Permanent & Mobile Rock Wall Structures, Security Forces, Trampolines, and Zip Lines

Coverage is available separately for any race, timed-event or other event organized and/or sponsored by your Club and referenced under “Event Coverage” below. Such Event Coverage would cover any Member, non-Member or General Public participants registered for the event.

War, Terrorism, Expected or Intended Injury, Asbestos, Nuclear Energy, Total Pollution, Fungi or Bacteria, Aircraft or Watercraft, Pyrotechnics, Employment Related Practices, Communicable Disease (Hepatitis, TSE, HIV, HTLV, or AIDS) and Lead Liability

State of NY, KS, PA and WA: Coverage is available, however, minimum premiums of $2000 will apply (includes Blanket Additional Insured status and no RPG fee will apply).

States of OK, NH and VT: Coverage is available, but includes state specific RPG declarations page.

Additional Insured parties may be added at no charge.

NOTE: 25% of total premium is Fully Earned at Inception. RPG Fee is non-refundable.

The Optional Coverage(s)

Heavy machinery/Operation of mobile equipment coverage

This option removes the exclusion for use of ‘mobile equipment’ as defined in the policy.

HIRED AND NON-OWNED AUTOMOBILE LIABILITY COVERAGE

This liability coverage provides protection for rented, borrowed and other non-owned vehicles driven on race event business and club related activities. Note: Coverage is ineligible for 12+ passenger vans and U-Haul’s, Penske’s, box trucks, etc.

Inland marine (equipment) coverage

Provides property coverage for owned or rented equipment. Deductible will apply.

Liquor liability coverage

Minimum Premiums can apply and vary by state. Note: host liquor liability is automatically included in the standard General Liability coverage above.

Excess Liability

$1,000,000 Excess Liability coverage available.

PART II: SPECIAL EVENT LIABILITY COVERAGE

Coverage for Special Events organized and/or sponsored by your Club and open to the General Public and non-Member individuals.

Separate Subscribing Member Certificate issued with separate set of Limits applying to each Certificate.

Coverage Limits, terms and conditions same as above unless otherwise noted.

NOTE: 25% of total premium is Fully Earned at Inception. RPG Fee is non-refundable.

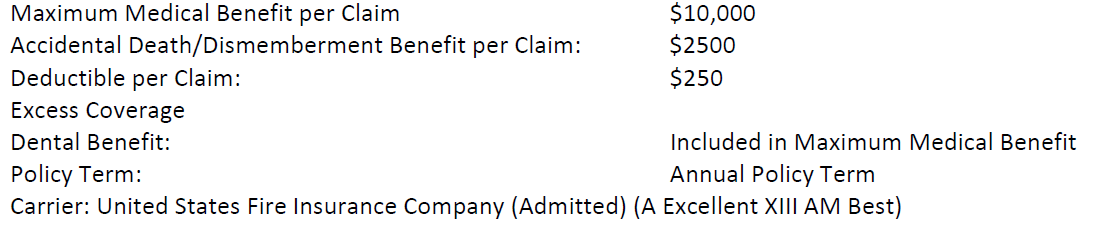

EVENT PARTICIPANT ACCIDENT COVERAGE

BENEFITs:

eligibility:

All Participants & Staff of the Policyholder’s Programs.

Coverage must be purchased in conjunction with Event Liability coverage.

The first such expense must be incurred within 90 days after the date of the accident.

"Eligible expense" means charges for the following necessary treatment and service, not to exceed the usual and customary charges in the area where provided.

Excess coverage: This plan does not cover treatment or service for which benefits are payable or service is available under any other insurance or medical service plan available to the Covered Person.

Insurer

The General Liability coverage provided by Everest Insurance "A+ XV" (Excellent) rated by A.M. Best Company.

Accident coverage provided by an "A" (Excellent) rated by A.M. Best Company.